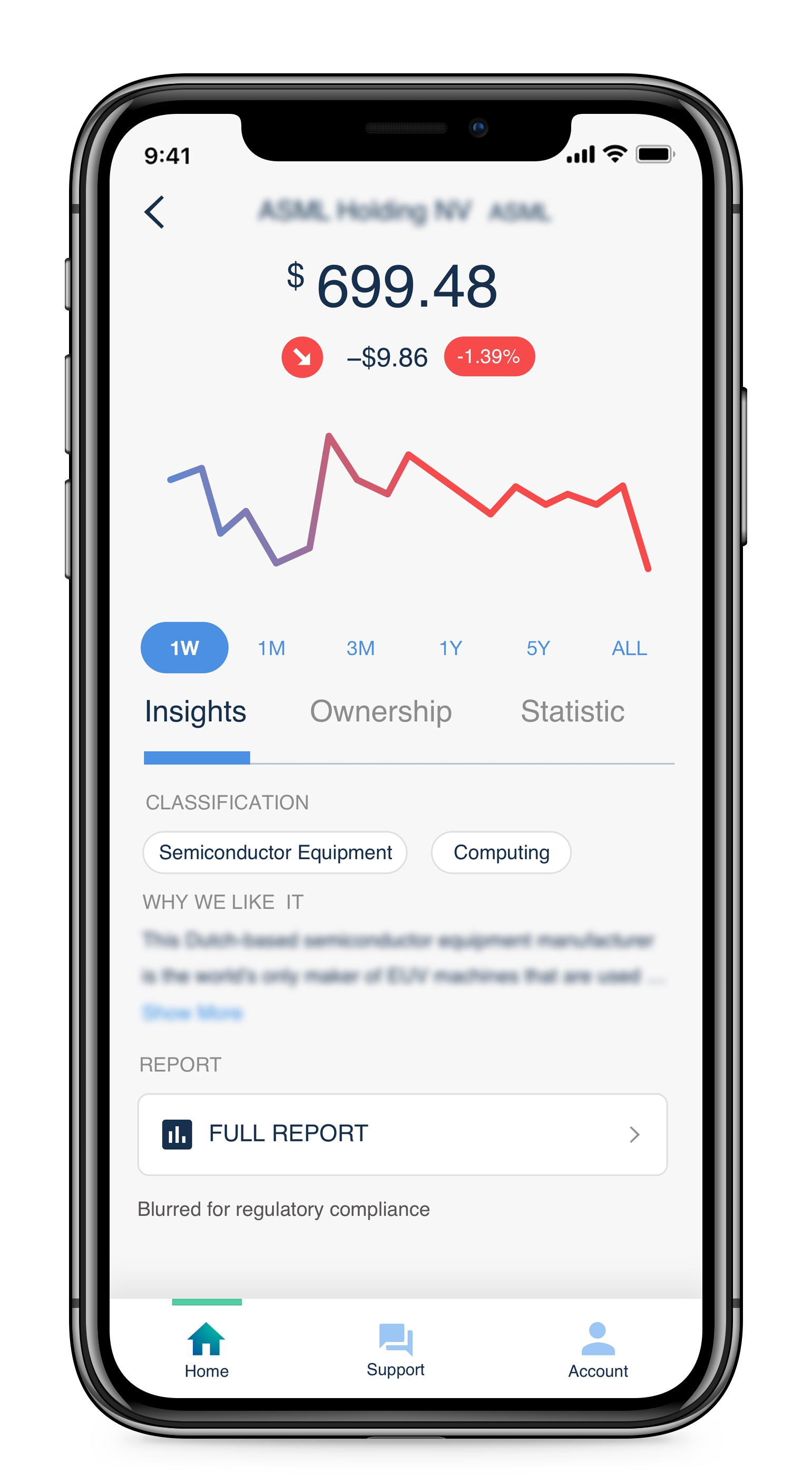

Premium experience We don’t just manage your investments, we help you learn along the way!

Easy to use

Quickly onboard and set up an account in under 5 minutes.

Low minimum and fractional trading support means you can get in the game.

Account Protection

We are SEC-registered and all accounts are separately managed with up to $500,000 in SIPC insurance.

No lock-in either: cancel and close your account anytime.